Is the Dollar’s Reign Ending? Global Funds Signal a Historic Shift

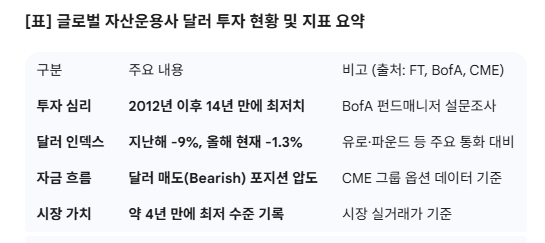

The U.S. dollar is facing unprecedented selling pressure, with fund managers reducing their positions to levels not seen in 14 years. This dramatic shift is fueling speculation that the era of “King Dollar” dominance may be drawing to a close, prompting concerns and analysis from financial institutions worldwide. The confluence of factors driving this trend – from shifting global economic landscapes to evolving geopolitical dynamics – suggests a potentially significant restructuring of the international financial order.

Recent data reveals a substantial decrease in dollar holdings among global fund managers, a move that analysts at Bank of America (BofA) attribute, in part, to concerns about the currency’s diminishing purchasing power. This isn’t simply a matter of market fluctuations; it represents a fundamental reassessment of the dollar’s long-term viability as the world’s reserve currency.

The Historical Context of Dollar Dominance

For decades, the U.S. dollar has enjoyed a privileged position in the global economy, underpinned by the size and stability of the American economy, the depth of its financial markets, and its role as the primary currency for international trade. This dominance has afforded the U.S. significant economic and geopolitical advantages, allowing it to borrow at lower rates and exert considerable influence over global financial flows. However, this position isn’t immutable.

Factors Contributing to the Dollar’s Decline

Several factors are converging to challenge the dollar’s supremacy. Rising debt levels in the United States, coupled with persistent trade deficits, have raised questions about the long-term sustainability of the dollar’s value. Furthermore, the increasing economic clout of countries like China, and the emergence of alternative currencies and payment systems, are providing viable alternatives to the dollar. The geopolitical landscape also plays a role, with some nations seeking to reduce their reliance on the dollar to mitigate the risk of U.S. sanctions or political pressure.

Despite these headwinds, some analysts remain optimistic about the dollar’s prospects. A managing director recently stated that the current dollar value is a natural reflection of economic growth, anticipating a first-quarter growth rate potentially exceeding 6%. This perspective highlights the ongoing debate surrounding the dollar’s future.

The situation is further complicated by global events. Reports indicate that former President Trump’s policies are perceived as a potential risk to the dollar’s hegemony, igniting volatility in global financial markets. This “sword dance,” as some analysts describe it, underscores the sensitivity of the market to political developments.

Did You Know? The dollar’s share of global foreign exchange reserves has been steadily declining over the past two decades, although it remains the dominant currency.

Implications for the Global Economy

A significant decline in the dollar’s value could have far-reaching consequences for the global economy. It could lead to increased inflation, as import prices rise for countries that rely heavily on dollar-denominated goods. It could also trigger capital flight from the United States, as investors seek higher returns elsewhere. Conversely, a weaker dollar could boost U.S. exports, making American goods more competitive in international markets.

What impact will a potential shift away from the dollar have on emerging markets? And how will central banks around the world adjust their monetary policies in response to these changing dynamics?

Frequently Asked Questions About the Dollar’s Future

The future of the U.S. dollar remains uncertain. While the currency still enjoys significant advantages, the forces challenging its dominance are growing stronger. The coming months and years will be crucial in determining whether the era of “King Dollar” is truly coming to an end.

Share this article with your network to spark a conversation about the future of the global financial system! What are your thoughts on the dollar’s potential decline? Leave a comment below.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Discover more from Archyworldys

Subscribe to get the latest posts sent to your email.