UK Budget 2025: Tax Threshold Freeze and Economic Concerns Dominate Reaction

The UK’s latest budget proposal, unveiled by Shadow Chancellor Rachel Reeves, has sparked a flurry of reactions, ranging from comparisons to fictional miser Ebenezer Scrooge to serious concerns about its potential impact on economic growth and household finances. The plan, which includes a freeze on income tax thresholds, is facing scrutiny from across the political spectrum and is prompting individuals to calculate the potential reduction in their take-home pay.

The Core of the Budget: A Deep Dive

Rachel Reeves’ budget centers around a commitment to fiscal responsibility coupled with strategic investments. A key component is the decision to maintain existing income tax thresholds, effectively meaning that as wages rise, more individuals will be pushed into higher tax brackets, even if their real income hasn’t increased proportionally. This measure is projected to generate significant revenue for the government, but critics argue it will disproportionately affect middle-income earners.

The Office for Budget Responsibility (OBR), the UK’s independent fiscal watchdog, has cautioned that the proposed measures are unlikely to deliver substantial economic growth. This warning has fueled debate about the budget’s overall effectiveness and whether it prioritizes short-term revenue gains over long-term economic prosperity. The Independent reports on the OBR chief’s concerns, highlighting a disconnect between the budget’s aims and projected outcomes. Read more about the OBR’s assessment here.

The BBC notes the contrasting reactions, with some characterizing the budget as “high welfare, high tax” while others view it as largely as expected. See the BBC’s coverage for a balanced overview.

Several key measures are included in the budget proposal, as outlined by RTE.ie. These include adjustments to various tax allowances and spending commitments.

The impact on individual finances is a major concern. Sky News provides a tool allowing users to estimate the reduction in their take-home pay due to the income tax threshold freeze. Calculate your potential loss here.

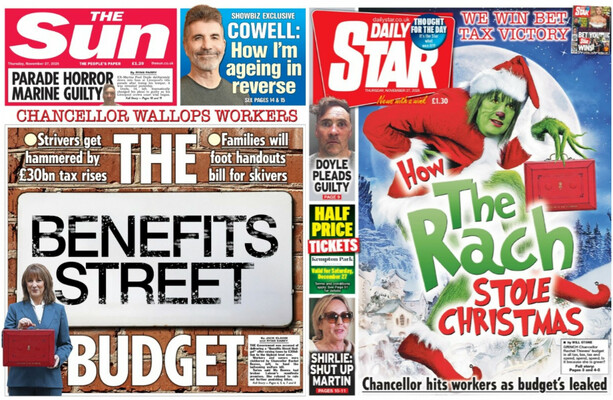

The reaction from UK newspapers has been mixed, with some drawing comparisons to Charles Dickens’ “A Christmas Carol,” labeling Reeves as a modern-day “Scrooge” for her perceived austerity measures. The Journal details these comparisons and the broader media response. Read the full analysis of newspaper reactions here.

But what does this budget truly mean for the average citizen? Will it stimulate economic growth, or will it stifle spending and investment? These are the questions at the heart of the debate.

Do you believe this budget prioritizes long-term economic stability, or is it a short-sighted attempt to address immediate fiscal challenges? What impact do you anticipate this budget will have on your household finances?

Frequently Asked Questions

What is the income tax threshold freeze?

The income tax threshold freeze means that the amount of income you can earn before paying higher rates of tax will not increase with inflation. This effectively means more people will be pushed into higher tax brackets, even if their real income remains the same.

How will the budget affect my take-home pay?

If your income is rising, the threshold freeze means a larger portion of it will be taxed at a higher rate, reducing your take-home pay. You can use tools like the one provided by Sky News to estimate the impact on your specific circumstances.

What are the main criticisms of Rachel Reeves’ budget?

Critics argue that the budget prioritizes revenue generation over economic growth and that the income tax threshold freeze will disproportionately affect middle-income earners. The OBR has also expressed concerns about the budget’s impact on long-term economic prospects.

What key measures are included in the proposed budget?

The budget includes a freeze on income tax thresholds, adjustments to various tax allowances, and specific spending commitments. RTE.ie provides a detailed overview of these measures.

How have UK newspapers reacted to the budget?

Reactions have been mixed, with some newspapers drawing comparisons to Ebenezer Scrooge and criticizing the budget’s austerity measures, while others view it as a pragmatic approach to fiscal responsibility.

Discover more from Archyworldys

Subscribe to get the latest posts sent to your email.